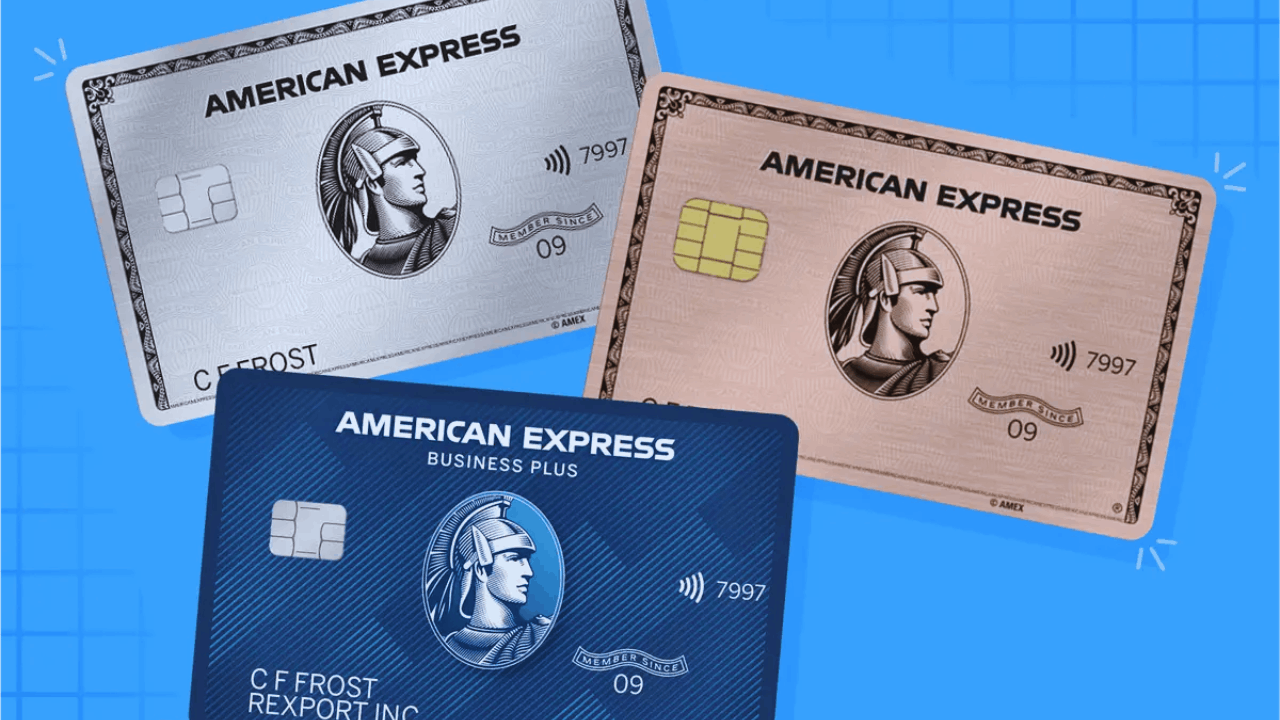

American Express credit cards are the epitome of luxury and generosity. They offer tons of features, rewards, perks, and many other benefits that only you as a cardholder can experience.

With so many options, American Express offers a lot of credit cards that fit exactly what you need in your life right now. You can choose from a wide variety of cards that offer generous rewards, luxurious perks, and a lot of credit limits.

If you want to learn which American Express Credit Card is for you, check out the guide below to discover more options.

American Express Credit Cards: Premium Perks & Membership Rewards

There’s a wide variety of American Express credit cards out there that surely would fit exactly what you’re lifestyle is all about.

You can either earn cashback from your groceries, earn points from dining and flights, or get access to premium airport lounges and have the best experience while traveling.

All of these can be yours depending on the American Express credit card that you choose.

How to Choose Which American Express Credit Card is For You

To choose which American Express Credit Card is for you, you need to determine first how you want to spend your credit limit.

Cardholders who want to spend more on travel should choose cards that excel at travel rewards.

You can also earn cashback rewards or tons of other premium perks that can only be experienced through American Express. You can choose to go with travel and dining, and even have a unique mix of rewards and benefits.

American Express Platinum Credit Card

The American Express Platinum Credit Card is probably one of the best credit cards out there.

You get to enjoy premium features and membership rewards through AmexTravel.com. You earn 5X Membership Rewards points for every flight booked with your card through the website.

Cardholders also get a $240 digital entertainment credit for eligible transactions on streaming services. Additionally, you have complimentary access to the exclusive American Express Global Lounge Collection.

If you’re looking to get the most out of your credit card, the American Express Platinum Credit Card should be your ultimate choice.

Interest Rates and Other Fees

The American Express Platinum Credit Card has an interest rate of 20.24% to 29.24% variable. There is also an annual fee of $695.

The cash advance fee is either $10 or 5% of the amount to be advanced. There is a late payment fee of $40 and a returned payment fee of up to $40 as well.

American Express Gold Card

The American Express Gold Card offers 4X Membership Rewards points when you spend on restaurants and takeouts using the card and earn up to $50,000 worth of points.

There are also 4X Membership Rewards points for every grocery transaction at US Supermarkets for up to $25,000 worth every year. Maximize your experience with dining and groceries with the American Express Gold Card.

If you find yourself dining with family and friends all the time, this is the perfect credit card for you.

Interest Rates and Other Fees

The American Express Gold Card has an annual fee of $325 per year and an interest rate of 20.24% to 29.49%. Take note that variable APRs will not exceed 29.99%.

Cash advance fees, as well as late payment and returned payment fees, are similar to those of other cards.

American Express Blue Cash Everyday Card

If you’re looking to get the most rewards out of your credit card for the whole family, you might want to check out the American Express Blue Cash Everyday Card.

Cardholders get 3% cash back on groceries at US Supermarkets, 3% cashback on online retailers, 3% cashback on fuel at US gas stations, and 1% on any other transactions from eligible purchases.

For the rest of the family, you get a $84 Disney Bundle Credit once you enroll the card and spend $9.99 on the Disney Bundle.

There is also a $180 Home Chef Credit that gets you up to $15 in statement credits every month for food delivery services.

Interest Rates and Other Charges

The American Express Blue Cash Everyday Card has an interest rate of 20.24% to 29.24% variable.

There is no annual fee, which can be quite an enticing offer, especially with the rewards and offers that you get with this card.

Cardholders can expect a 0% intro APR for 15 months from the date the account is opened.

American Express Blue Cash Preferred Card

If you prefer a better option with more streaming service features, you might be interested in getting the American Express Blue Cash Preferred Card.

You get 6% cashback on groceries at US supermarkets up to $6,000 in purchases every year, as well as 6% cashback on US streaming services.

Cardholders also have 3% cashback on fuel at US gas stations, 3% on transit, tolls, parking, trains, and buses, and 1% cashback on all other transactions and purchases.

If you are looking to spend more on entertainment and groceries, this should be your preferred credit card.

Interest Rates and Other Charges

The American Express Blue Cash Preferred Card has a zero annual fee for the first year and then $95 after that.

The card also has a variable interest rate of 20.24% to 29.24%. There is a 0% intro APR on purchases and balance transfers in the first 12 months.

How to Apply for the American Express Credit Card

You must be eligible to apply for an American Express credit card. This means you must have the corresponding credit score and income as required for the credit card of your choice.

Once you have the documents, you can apply directly at the official website. Choose the American Express credit card that you like and click Apply.

Fill out the online application form and review everything before you submit it. Once approved, your card will be sent to you by mail.

Contact Details

If you need assistance with the application or have questions about the American Express card of your choice, you can contact their customer service through the hotline at 1-800-528-2122.

You can also visit their main office located at 200 Vesey Street, New York, NY 10285-3106.

Conclusion

The best reason to choose an American Express credit card truly depends on your needs. Try to align your needs with the benefits that each American Express credit card has to offer.

Compare the fees and other charges so you get the most value out of the card that you have chosen.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.