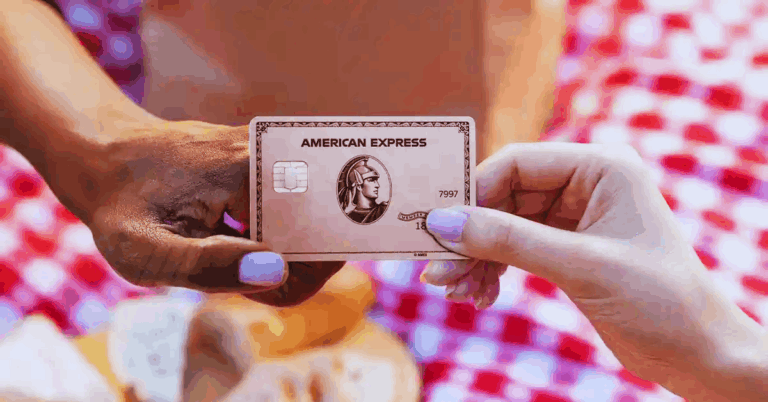

With so many credit cards, it can be difficult to find one that truly fits your financial goals. Capital One is the perfect example of a financial institution that offers a wide variety of credit cards and other financial options.

If you’re looking to apply for a Capital One credit card, make sure to check out the guide below, explore the top Capital One credit cards for comparison, and find the right fit.

Capital One Platinum Mastercard

The Capital One Platinum Mastercard is an all-in-one credit card for Capital One enthusiasts.

It delivers everything that you need for a credit card. Features such as security and protection, travel and retail, as well as proper account and financial management, are where it truly shines.

Key Highlights and Features

The Capital One Platinum Mastercard lets you enjoy up to 50% off on all handcrafted beverages at any Capital One Cafe all over the country. You can use the Find Your Cafe feature on the app or the website to locate the nearest cafe.

With the Capital One Platinum Mastercard, you can simply use it for any transaction by tapping it on the terminal. Managing your account is way easier with the card now that you can access it through the mobile banking app.

On the app, you can check all of your transactions, set up autopay, assign an authorized user, and even make a balance transfer.

Interest Rates and Other Charges

With the Capital One Platinum Mastercard, you’ll have a variable interest rate of 29.74% on purchases. There is no annual fee or any foreign transaction fee with this card.

This means you can use the card in many other countries without incurring any charges. The late payment fee is up to $40.

The cash advance fee is either $5 or 5% of the total amount being advanced. The balance transfer fee is 4% of the total amount transferred.

Capital One Savor Rewards

If you’re looking for a Capital One credit card that lets you earn cashback rewards, the Capital One Savor Rewards is the ultimate choice.

You can earn a one-time bonus by just opening an account, and even earn cashback rewards for every eligible transaction that you make.

It is currently the number one cashback rewards credit card that Capital One has to offer.

Main Features and Perks of the Capital One Savor Rewards Card

With the Capital One Savor Rewards Card, you get a welcome bonus of up to $200 when you spend more than $500 within 3 months of opening your account.

The card also features a very promising cashback rewards program with up to 5% unlimited cashback on hotels and rental cars booked within the Capital One Travel portal.

You also get 3% unlimited cashback on groceries, dining, entertainment, and streaming services, as well as 1% on any other transactions made with the card. You can then redeem your rewards through PayPal.

Interest Rates and Other Charges

The Capital One Savor Rewards Card has zero annual fees and offers a competitive interest rate starting at 19.24% to 29.24%.

There is also a 0% intro APR for the next 12 months on purchases and balance transfers, then it would revert to the agreed-upon interest rate after that.

The card also doesn’t charge you any foreign transaction fees when you make a purchase outside the United States.

Capital One Venture X Rewards

If you’re on the more adventurous side and you want to take full advantage of your travel rewards, the Capital One Venture X Rewards Card is your ideal credit card.

Everything about the card screams a comfortable and convenient travel experience while also earning travel rewards.

Benefits and Features of the Capital One Venture X Rewards Card

The Capital One Venture X Rewards Card is the perfect travel rewards credit card for you if you love travel and adventure. With the card, you can earn 75,000 bonus miles after spending $4,000 for the first 3 months of opening your account.

You also get $300 travel credits for bookings made through the Capital One Travel platform. When you reach your first anniversary, you also get 10,000 bonus miles.

Every time you use the card for hotels and rental cars, you get 10X miles, especially when booked through Capital One Travel. You get 5X miles for flights and vacation rentals, and 2X miles on all other transactions.

Interest Rates and Other Charges

The Capital One Venture X Rewards Card has a $395 annual fee, which may put off some people from applying for this card.

However, the competitive interest rate ranges from 19.99% to 29.24% on purchases. There is no foreign transaction fee for the card.

Check If You’re Pre-Approved Before Applying

One of the best features when applying for any Capital One credit card is that you can see if you are pre-approved for the card that you’re most interested in.

To do this, you just need to head over to the official website and answer pre-approval questions. You need to share some personal information, like your income and birth date.

You’ll then find out if you’re approved so you can continue with your application. Check the terms and conditions and see if you agree with them.

If you agree, you can proceed with the application.

Applying for the Capital One Credit Card

Submit your application by providing more personal details. You will also be required to submit several more documents during the application process.

Review everything to ensure the information is accurate and up to date. Double-check the terms and conditions before you submit.

Once approved, your card will be sent by mail.

Contact Details

If you have inquiries regarding the credit card or you need assistance with the online application, you can contact their customer service hotline for help. You can dial the number 1-800-CAPITAL (227-4825).

You can also check your nearby Capital One branch or visit their main office located at Capital One Financial Corp, 1680 Capital One Drive, McLean, VA 22102-3491 United States.

Conclusion

Capital One has a myriad of options when it comes to credit cards. There’s so much to choose from, depending on your financial goals or the lifestyle that you want.

Make sure that you review all of the details, including the features, perks, benefits, terms, and conditions, before you apply for the card.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.