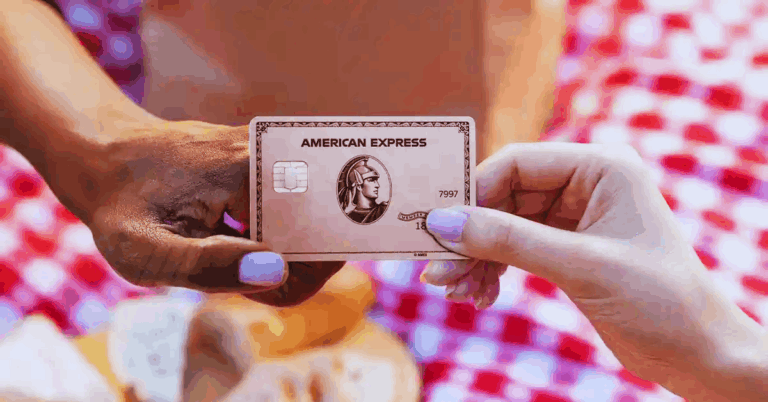

Smart card choices support worldwide budgeting goals and improve credit profiles over time.

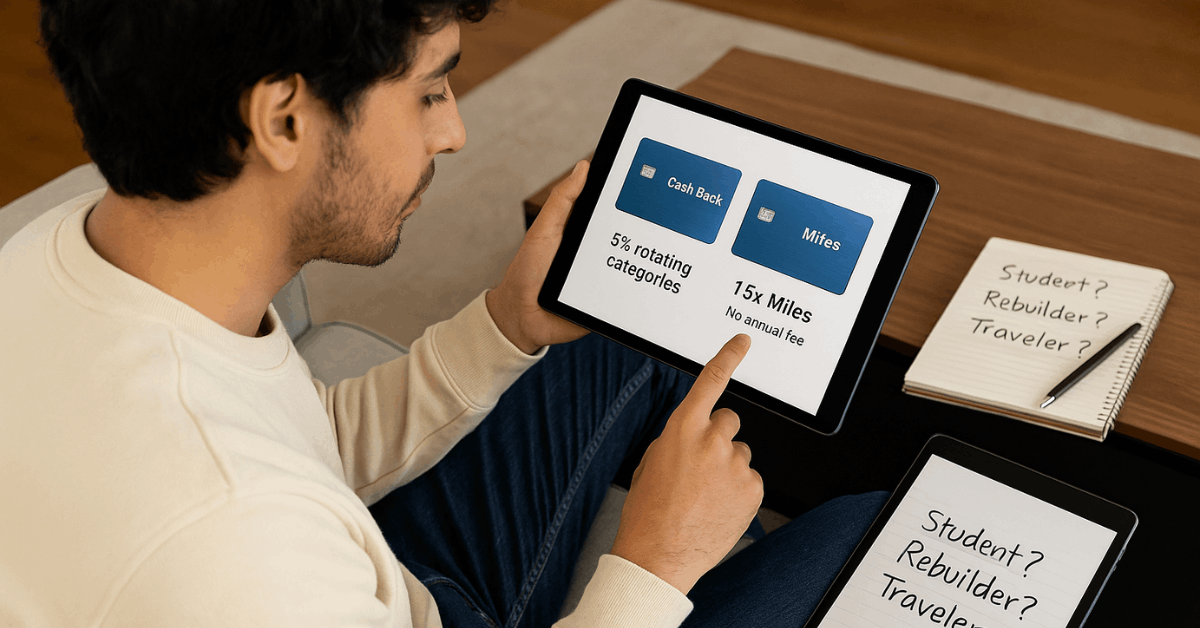

Choosing among Discover options is easier when you know each product’s focus and long-term cost structure.

Why Consider the Discover Portfolio?

A single issuer rarely combines zero annual fees, transparent rates, and consistent customer satisfaction. Discover does, while also offering worldwide fraud safeguards and an industry-leading first-year Cashback Match that doubles every reward you earn.

Core Product Families

Four primary families cover most spending patterns and credit stages. Each card retains zero annual fees and U.S.-based support.

Cashback Lineup

Discover it® Cash Back maximizes everyday spending once categories are activated each quarter.

- 5 % cashback on quarterly rotating categories, capped at $1 500 in purchases.

- Unlimited 1 % on all additional purchases.

- Intro 0 % APR on purchases and transfers for 15 months, then a variable 18.24 %–27.24 %.

- First-year Cashback Match automatically doubles rewards.

Discover it® Chrome delivers steady returns without activation steps.

- 2 % cashback at gas stations and restaurants on the first $1 000 combined each quarter, then 1 %.

- 1 % on every other purchase.

- Six-month 0 % intro APR for purchases.

Student Lineup

Discover it® Student Cash Back mirrors the standard cashback card while forgiving the first late payment and rewarding good grades.

- Same 5 % rotating categories and first-year Cashback Match.

- Intro 0 % APR for six months on purchases.

- Variable APR afterward: 17.24 %–26.24 %.

Discover it® Chrome for Students favors food and transport budgets.

- 2 % at gas stations and restaurants on up to $1 000 quarterly, 1 % elsewhere.

- No rotating categories or annual fee.

Secured Lineup

Discover it® Secured builds or rebuilds credit while still paying rewards.

- 2 % cashback at gas stations and restaurants (up to $1 000 quarterly), 1 % on everything else.

- The security deposit, starting at $200, determines the credit line.

- Accounts are reviewed monthly after seven months for possible graduation to an unsecured product.

- Variable APR currently 27.24 %.

Miles Variant

Frequent travelers seeking uncomplicated earnings can choose Discover it® Miles, which returns 1.5 miles per dollar on every purchase worldwide and lets miles erase travel expenses at the same cent-per-mile value.

Balance Transfer Offer

Heavy revolvers can shift existing debt to Discover Balance Transfer versions that include 0 % intro APR on transfers (3 % fee until July 10, 2025) and extended 0 % purchase financing, providing breathing room for payoff plans.

Shared Features That Cut Costs and Stress

All Discover cards include:

- No annual fees, ensuring rewards stay in your pocket.

- U.S.-based 24/7 support through phone or chat for quick worldwide assistance.

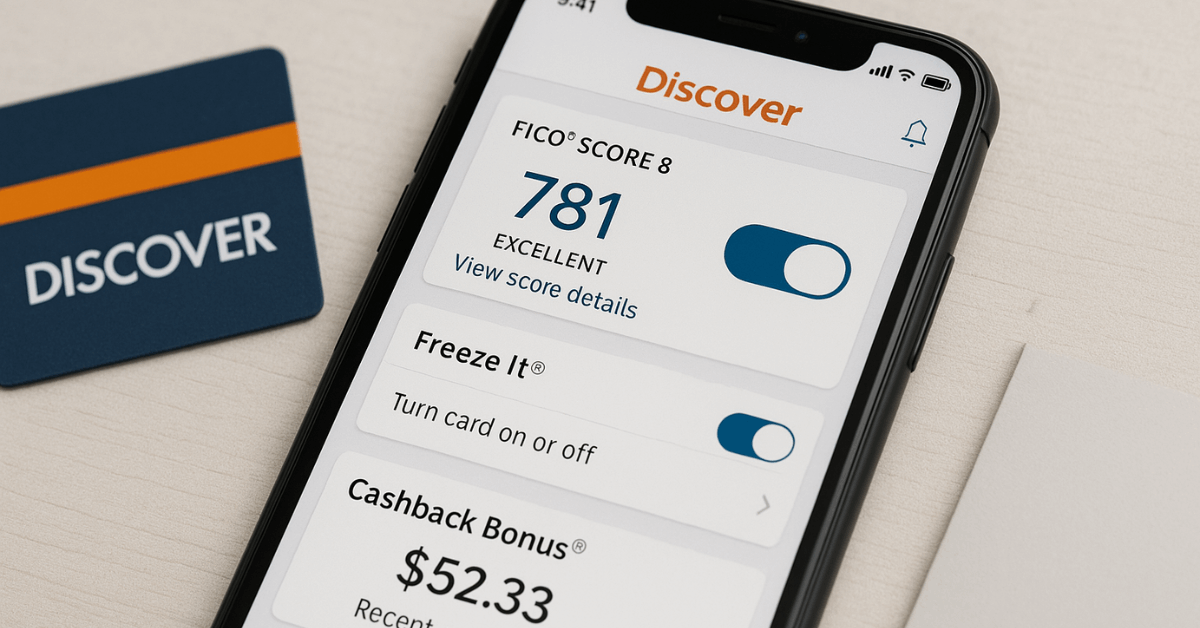

- Freeze It® switch within the app to block new charges instantly.

- $0 fraud liability on unauthorized transactions.

- Free FICO® score updates every month, reported to all major bureaus.

Picking the Right Discover Card

Choosing boils down to your typical spending pattern and current credit status. Heavy category spenders gain maximum value from Discover it Cash Back, while students needing a starter limit benefit from the Student editions.

Builders who can post a refundable deposit start safely with Discover it Secured and graduate later. Travelers wanting flat earnings select Discover it Miles to turn every purchase into future flights.

How Cashback Match Generates Extra Value

Keeping your account open and in good standing for twelve months triggers an automatic lump-sum match of all rewards earned in that period.

No enrollment, thresholds, or category hoops exist, so every dollar you collect effectively doubles in the first year—an advantage few worldwide issuers replicate.

Managing Rotating Categories Smoothly

Quarterly bonus calendars typically feature supermarkets, digital wallets, gas, restaurants, or Amazon.

Activation takes ten seconds online or in-app, and spending above $1 500 reverts to unlimited 1 %. Setting a recurring calendar reminder ensures you never miss the higher rate.

Redeeming Rewards Worldwide

Cashback never expires while the account remains open, and redemptions start at a single cent. You can:

- Apply as a statement credit.

- Direct deposit to any linked bank.

- Check out instantly at Amazon or PayPal.

- Exchange for gift cards that may carry added value.

Tools and Support

When using a credit card from Discover, you will benefit from these tools and support:

Mobile App and Online Dashboard

The Discover app centralizes payments, transaction alerts, score tracking, and the Freeze It® toggle. Worldwide travelers can verify charges in real-time and unlock the card when back within service range.

Security Technology That Protects You

Continuous dark-web monitoring for your Social Security number, triggered notifications for large purchases, and two-factor logins reduce fraud risk on a global scale.

Customer Service Experience

Independent surveys consistently rank Discover among the top U.S. issuers for satisfaction. Wait times remain low, and representatives resolve most issues during the first call.

Pros and Potential Drawbacks

Strengths:

- High first-year reward acceleration through Cashback Match.

- Zero maintenance costs across the board.

- Robust credit-building pathway via secured graduation reviews.

- Transparent, easy-to-read statements and app UI.

Considerations:

- Overseas acceptance trails Visa and Mastercard networks in certain regions, so carrying a backup card is prudent for worldwide travel.

- Activation is required every quarter to unlock 5 % categories, which some users may overlook.

How Discover Stacks Up Against Amex, Chase, and Citi

Cashback Match beats the introductory bonuses of most direct competitors, and the absence of annual fees lowers lifetime ownership costs.

Chase excels at premium travel perks, while Citi offers broader international acceptance. Selecting the ideal provider ultimately hinges on whether you prioritize simple cash returns or layered travel benefits.

Credit-Building Blueprint for New Users

Responsible use, reported monthly to all bureaus, quickly converts on-time payments into score improvements.

Pairing automated reminders with the free FICO dashboard helps keep utilization within healthy ranges worldwide, thereby smoothing future approvals for auto, home, or business funding.

Decision Framework for First-Time Cardholders

You need to prioritize these key features:

- Variable APR after intro period: Compare the full range, not just the 0% teaser.

- Fee structure: Verify balance-transfer, cash-advance, and foreign-transaction costs.

- Reporting cadence: Ensure all bureaus receive data to maximize score growth.

- Reward relevance: Align category bonuses with your actual spending.

Online comparison engines filter products by credit score, rewards, and fees, compressing research that once took hours into minutes. Checking simulated approval odds before submitting applications protects your score from unnecessary hard pulls.

Disclaimers and Contact Information

Rates, fees, and reward structures are subject to change periodically; please confirm current terms directly through Discover’s official channels. Eligibility depends on individual creditworthiness and applicable regulations in your country or region.

- Website: www.discover.com

- Phone: 1-800-DISCOVER (1-800-347-2683)

- Support Hours: 24/7, U.S.-based

Conclusion

Discover credit cards blend high first-year earnings, zero annual fees, and strong security into an accessible package for shoppers, students, and credit rebuilders worldwide.

Selecting a version that aligns with your spending habits and credit goals positions you for efficient rewards and steady score growth, without hidden complexities.