Everyone has had a bad credit score at some point in their lives. In this economy and environment, someone will inevitably maintain a credit score that high.

If you’re having problems with maintaining your credit score or if you have a poor credit score, it’s time to learn how to improve or reconstruct your credit score as fast as possible.

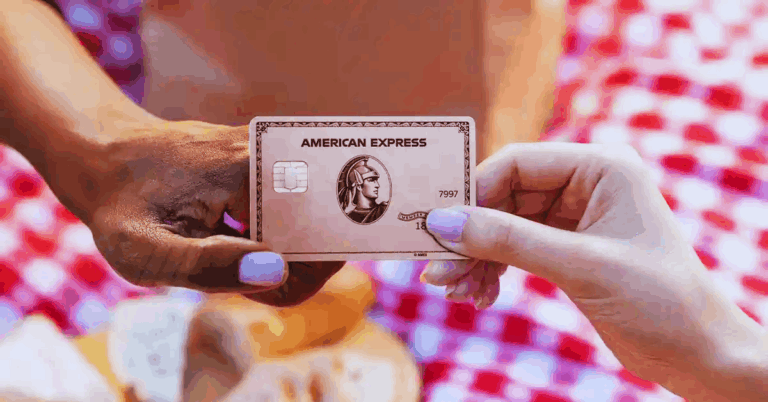

Unsecured credit cards, such as the Mission Lane Visa Credit Card, are some of the best ways to do this. Check out the guide below to learn more about the Mission Lane Credit Card and how to build your credit with no hidden fees.

Key Highlights of the Mission Lane Credit Card

The Mission Lane Credit Card has all the potential that you need to help you improve your credit score.

You gain access to features such as a chance to increase your credit limit, a low to no annual fee, and the ability to qualify for the card even with a bad credit score.

Check out what’s in store for you with the Mission Lane Credit Card.

Be Approved Even With a Bad Credit Score

Many people are wary of applying for a credit card, especially if they know they have a poor credit score. With the Mission Lane Credit Card, you can still apply and even get approved for the card.

The credit card provider can still offer you a competitive interest rate and a lot of features to help you improve your credit score.

This is why the Mission Lane Credit Card is the best option out there if you’re looking to build your credit back.

Reach a Higher Credit Limit Over Time

Other unsecured credit cards often have a limited amount of credit for the cardholder. There are no options for you to increase your credit limit, even though you have slowly built up your credit score.

With the Mission Lane Credit Card, you can reach a higher credit limit over time. All you need to do is make payments on time for the next 12 months, and you’ll be able to attain a credit limit increase.

Other Perks and Features of the Mission Lane Credit Card

The Mission Lane Credit Card functions very similarly to an ordinary credit card. You have a 24/7 pay-per-use roadside dispatch function and 24-hour support if your card gets lost or stolen.

There is also a $0 fraud liability for every purchase that you make. This means that any transactions that are proven to be fraudulent won’t be charged to your account.

This gives you peace of mind knowing that you won’t be charged with anything if your card has been compromised.

Annual Fee and Other Charges

The Mission Lane Credit Card does have an annual fee of $39 and an interest rate of up to 33.99%, depending on your credit score and creditworthiness during your application.

There is also a 3% foreign transaction fee. The best part is that there is no security deposit required for you to use the card. You’ll have a starting credit line ranging from $300 to $3,000, depending on your creditworthiness.

Take note that all of your payments and activity will be reported to the three credit bureaus. There are no hidden fees with this credit card.

Who is the Mission Lane Credit Card For?

Anyone who has been struggling with their credit score can pick up the Mission Lane Credit Card.

It is one of the available options for those who have bad credit scores or those who want to revive their credit score.

There are also options for another type of Mission Lane Credit Card for those who want to establish their credit, and another option for those who already have better credit.

The Mission Lane Credit Card is focused on revitalizing your credit score through your effort to maintain on-time payments.

Contact Details

If you need assistance with the application of the card or you have inquiries regarding the card, you can contact their customer service hotline at 1-855-790-8860. They are available from Monday to Friday from 9 AM to 8 PM ET.

You can also check their main headquarters located in Atlanta, Georgia, 30348, United States.

How to Apply for the Mission Lane Credit Card

Applying for the Mission Lane Credit Card is fast and easy. Simply head over to the official website and check out which Mission Lane Credit Card is best for you.

For those who want to improve their credit score, you might want to choose the Mission Lane Green Credit Card, but other cards are available.

Take note that the suggested card will depend on the information that you have provided during the application.

Submitting Your Application

To start the application, head over to the official website and click on Get Started.

Fill out the online application form with your details, such as your legal name, address, date of birth, Social Security Number or Tax Income Number, as well as your financial information.

This includes your employment status, total annual income, and many other details. Make sure that the information is accurate and updated. Review everything, including the terms and conditions, before you submit.

After Submitting Your Application

After submitting, it only takes a few minutes for them to check your application to see if you’re eligible for the card.

They will then suggest which credit card is best suited for your current financial capabilities. If you want to accept the offer, proceed with the application.

Your card will then be sent to you by mail with the address that you used during the application.

Conclusion

Improving your credit score can be challenging if there are no credit card providers that can offer some form of help.

Fortunately, the Mission Lane Credit Card allows you to correct your credit score so you can enjoy more options in the future. Make sure that you follow the application process so you can get approved fast.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.