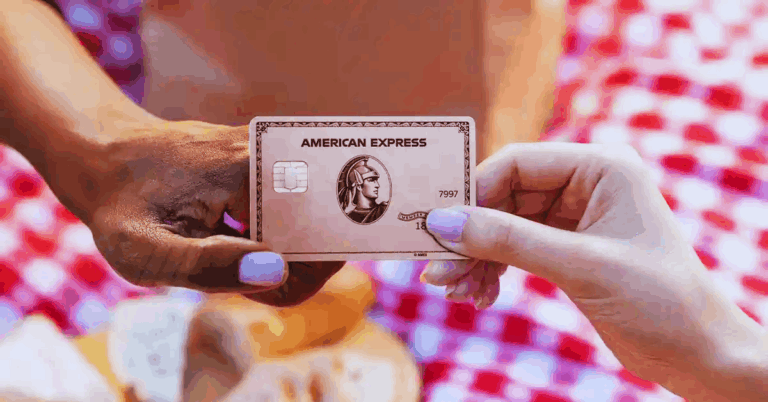

Earned money should accelerate progress, not sit idle.

The SoFi Credit Card channels every purchase toward investments, savings, or loan reduction, allowing you to strengthen your long-term goals with minimal effort.

Card Snapshot

Brief details help you confirm basic suitability before diving deeper.

| Feature | Details |

| Network | Mastercard World Elite (global acceptance) |

| Rewards Rate | Unlimited 2 % cashback when redeemed into SoFi accounts; 1 % as statement credit |

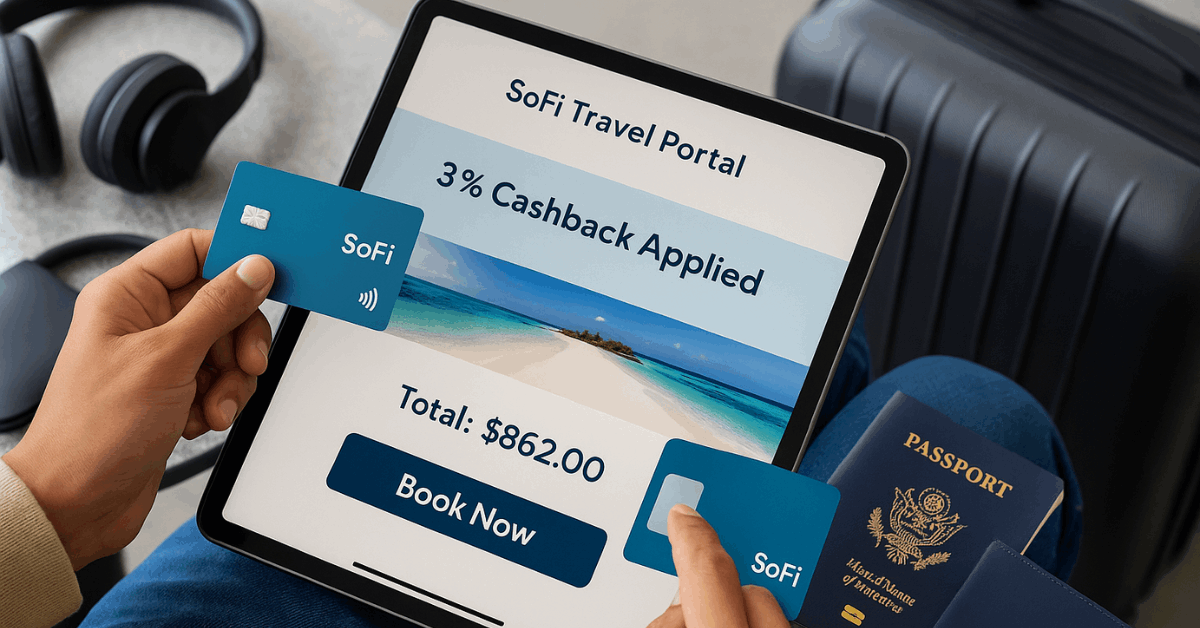

| Bonus Category | 3 % cashback on SoFi Travel Portal bookings |

| Annual Fee | $0 |

| Foreign Transaction Fees | $0 |

| Purchase APR | Variable 19.24 % – 29.74 % |

| Cell-Phone Insurance | Up to $1 000 per year |

| Key Perks | Lyft credits, ShopRunner shipping, Instacart+ trial |

Core Benefits That Drive Everyday Value

You secure multiple advantages in one product, reducing the need for several cards.

- Unlimited 2 % cashback on worldwide purchases whenever rewards flow into SoFi Invest, Checking, Savings, or eligible loan accounts.

- 3 % cashback on all reservations through the SoFi Travel Portal, helping you offset trip costs immediately.

- Zero annual and foreign fees, so international spending remains cost-effective.

- World Elite extras, including 24 ⁄ 7 concierge, travel protection, and free two-day ShopRunner shipping.

- Robust fraud and ID-theft coverage, giving you peace of mind on every swipe.

How the Cashback Engine Works

Understanding redemption mechanics ensures you collect full value instead of leaving money on the table.

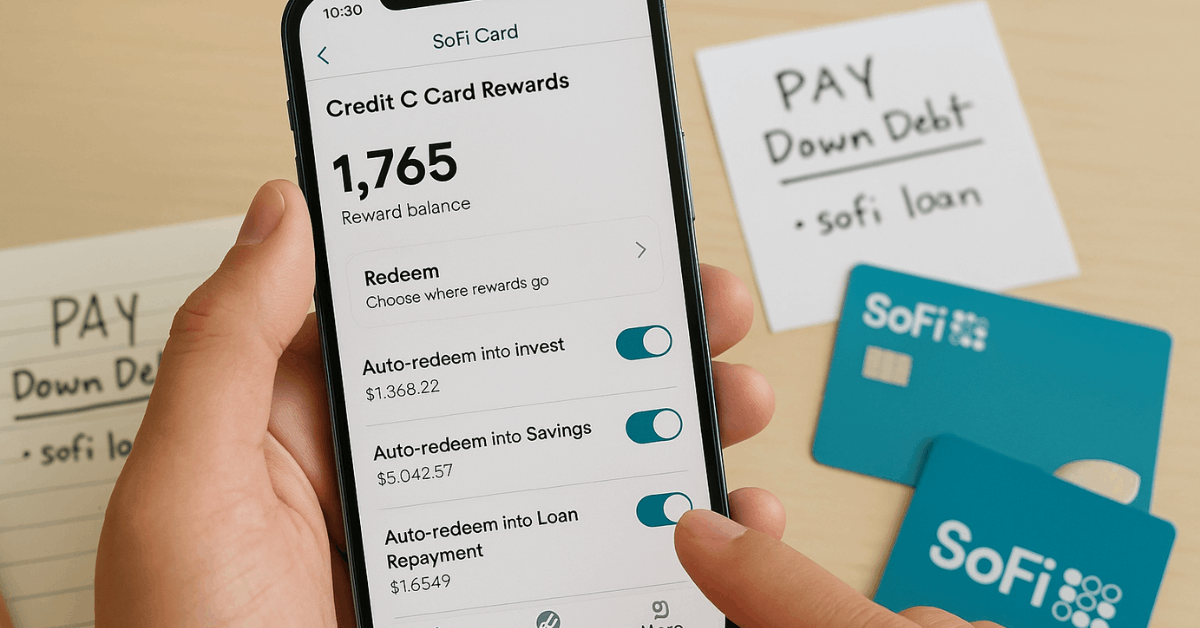

SoFi credits two reward points per dollar spent. Each point equals one cent when steered into SoFi products—effectively a flat 2 % rate. Choosing a statement credit cuts the point value in half, dropping the return to 1 %. Because redemptions have no minimum threshold and can run automatically, you never wait months to benefit.

Recommended Redemption Paths

Use these options to extract maximum utility.

- Investing via SoFi Invest – Direct points into stocks, ETFs, or crypto and watch spending contributions grow.

- Loan Repayment – Apply rewards toward student, personal, or mortgage balances and shrink future interest costs.

- High-Yield Savings – Boost emergency funds in SoFi Savings, earning up to 3.80 % APY when deposit requirements are met.

- Statement Credit – Reserve this lower-value route only when immediate bill relief outweighs growth potential.

Rates, Fees, and Cost Controls

Staying aware of borrowing costs protects hard-earned cashback from being wiped out.

- Purchase APR: 19.24 %–29.74 % variable, based on credit profile.

- Balance Transfers: Same range, plus a 5 % (or $10) fee.

- Cash Advances: 31.24 % variable and identical fee schedule.

- Late Payment: Up to $41; timely payments may cut APR by one point after twelve consecutive on-time cycles.

Pay balances in full during the 25-day grace period to avoid interest and preserve the entire 2 % reward.

Eligibility Essentials and Application Flow

Preparation streamlines approval and avoids unpleasant surprises.

Minimum Requirements:

- SoFi membership (free registration).

- Good-to-excellent credit history, typically 680 + .

- Agreement to SoFi Privacy Consent.

- U.S. residency (worldwide spending still supported).

Five-Step Digital Application:

- Navigate to the official SoFi Credit Card page and select Apply Now.

- Create or sign in to a SoFi profile.

- Provide personal details, income, and Social Security number.

- Choose the preferred reward destination inside the ecosystem.

- Review terms and submit; most decisions arrive within one minute.

A soft pull pre-approval lets you gauge terms without affecting your score.

Added Protections and Lifestyle Perks

Extra benefits elevate the card beyond a plain cashback tool.

- Cell Phone Protection: Up to $800 per claim, two claims yearly, triggered by paying the wireless bill with the card.

- Lyft Credit: Earn a $5 monthly ride credit after five rides paid worldwide.

- ShopRunner Membership: Enjoy free two-day shipping and streamlined returns across hundreds of retailers.

- Fandango Rewards: Collect a $5 bonus for every two movie tickets purchased through Fandango.

- Concierge Services: Get 24 ⁄ 7 assistance for travel, dining, and event reservations anywhere.

Integration Inside the SoFi Ecosystem

Centralized management reduces friction and keeps goals visible.

- Real-time reward tracking appears in the SoFi app moments after transactions clear.

- Automatic redemption routes points into chosen accounts, eliminating manual transfers.

- Direct-deposit customers gain up to a 10 % reward boost and premium banking features such as early paycheck access.

Comparison: SoFi vs. Popular Flat-Rate Rivals

Evaluating alternatives clarifies whether ecosystem integration outweighs standalone flexibility.

| Feature | SoFi Credit Card | Citi Double Cash | Chase Freedom Unlimited |

| Flat Rate Potential | 2 % (SoFi redemption) | 2 % (1 % earn + 1 % pay) | 1.5 % on everything |

| Ecosystem Growth | Invest, save, repay loans | Limited to statement credit or check | Requires Chase Travel Portal for best value |

| Annual Fee | $0 | $0 | $0 |

| Foreign Fees | None | 3 % | 3 % |

| Travel Category Bonus | 3 % via SoFi Travel Portal | None | 5 % on portal bookings |

You gain higher worldwide utility and wealth-building synergy through SoFi, while Citi offers similar base earnings without investment automation.

Quick Solutions for Common Card Issues

Prompt action keeps rewards and account health intact.

- Missing Cashback: Verify the transaction date; contact support if seven business days pass without points.

- Incorrect Reward Value: Screenshot activity inside the app and call 844-945-7634 for adjustment.

- Travel Portal Glitches: Clear browser cache or use the mobile app to complete bookings.

- Potential Fraud: Freeze the card instantly in-app and request an emergency replacement worldwide.

Strategies to Maximize Long-Term Gains

Following disciplined habits converts routine spending into measurable progress.

- Redeem every reward into SoFi accounts, avoiding the 50 % haircut on statement credits.

- Channel all airline, hotel, and car-rental bookings through the SoFi Travel Portal for the 3 % boost.

- Enable AutoPay for full-balance payments to sidestep costly interest charges.

- Set quarterly reminders to evaluate reward allocation, adjusting splits between investing and loan payoff as goals evolve.

- Capture limited-time category bonuses or referral incentives announced in the app.

Summary of Strengths and Weaknesses

A balanced snapshot assists quick decision-making.

Pros

- Unlimited 2 % cashback without category juggling.

- Deep integration with SoFi Invest, Banking, and Loans.

- $0 annual or foreign fees are perfect for worldwide usage.

- Valuable World Elite lifestyle benefits.

Cons

- Rewards drop to 1 % outside the ecosystem.

- Variable APR runs high for carried balances.

- Full value requires comfort with digital banking.

Disclaimer: Rates, fees, and offers are accurate as of June 10, 2025, and may vary by location and creditworthiness. Always verify terms directly with SoFi before applying. This content provides general information, not personalized financial advice.

Who Should Choose the SoFi Credit Card?

You benefit most when existing or planned SoFi relationships already handle investments, savings, or debt repayment.

The automatic 2% cashback funnel accelerates wealth creation and reduces financial friction, turning everyday transactions into tangible progress. Frequent travelers also appreciate fee-free international acceptance and built-in protections.

Consumers seeking purely statement-credit rewards or hesitant about app-centric money management may prefer a simpler flat-rate competitor.