U.S. Bank doesn’t always make headlines, but its credit cards quietly deliver real value.

From long 0% intro APR periods to flexible cashback programs, the lineup is built for practical, everyday use.

Low fees, strong security, and reliable customer service round out a set of cards that deserve a serious look, especially if you’re focused on saving money or earning steady rewards.

Why U.S. Bank Deserves a Spot in Your Wallet

Leverage a respected worldwide banking brand to reduce borrowing costs or boost everyday rewards. U.S.

Bank combines strong security, helpful customer service, and versatile card choices, giving you reliable tools no matter where you spend.

Millions of cardholders tap the bank’s range for two main reasons—extended 0% introductory APR periods that slash interest on transferred balances and flexible cashback programs that return money on routine purchases.

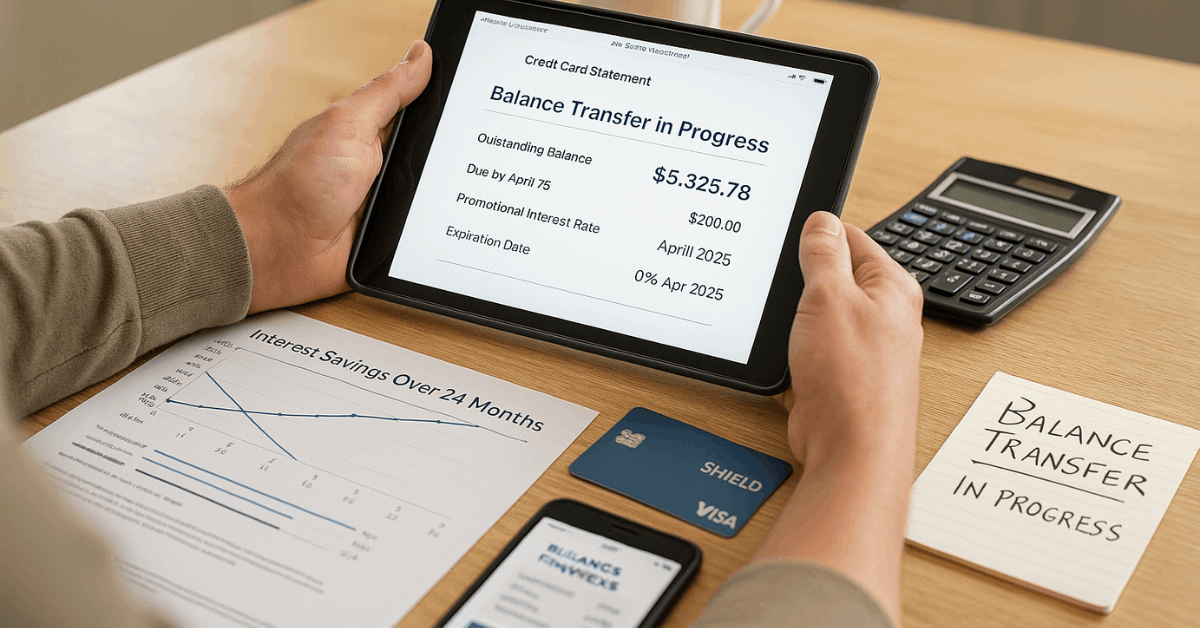

Balance Transfer Cards: Cut Interest, Clear Debt

Lowering interest immediately accelerates debt payoff. Two U.S. Bank cards deliver lengthy interest-free windows and zero annual fees, making them ideal for sizable balances.

U.S. Bank Shield™ Visa® Card:

- 0% intro APR on balance transfers for 24 billing cycles

- Variable APR 17.74%–28.74% after the promo ends

- Balance transfer fee 5% (minimum $5)

- 4% cashback on prepaid travel booked through U.S. Bank

- No annual fee, keeping costs lean while you repay

Choose this option when you need the longest possible breathing room. Twenty-four cycles provide two full years to eliminate transferred balances without interest pressure.

U.S. Bank Visa® Business Platinum Card:

- 0% intro APR on balance transfers for 18 billing cycles

- Variable APR 16.99%–25.99% afterward

- Balance transfer fee 3% (minimum $5)

- No annual fee

Entrepreneurs or freelancers can consolidate business debt worldwide and redirect interest savings toward growth expenses. Eighteen cycles cover a year and a half of interest-free repayment time.

Match the promo length to your payoff schedule. Longer windows suit larger balances; shorter periods still work if your debt load is modest.

Cashback Cards

Every swipe can earn money back when you select a card aligned with your purchase habits. U.S. Bank provides customizable and flat-rate options so rewards feel natural rather than forced.

U.S. Bank Cash+® Visa Signature® Card

Maximize returns by tailoring categories on a quarterly basis.

- 5% cashback on two chosen categories (up to $2,000 quarterly)

- 2% cashback on one fixed everyday category (gas, groceries, or utilities)

- 1% cashback on all other purchases

- 0% intro APR on purchases and balance transfers for 15 billing cycles

- Variable APR 18.49%–28.74% later

- No annual fee

Rotate categories to mirror shifting expenses, such as utilities in winter and home improvement in summer. Quarterly activation is essential; set calendar reminders so you never miss the higher rate.

U.S. Bank Altitude® Go Visa Signature® Card

Consistent earners who love dining out benefit from elevated points without micromanagement.

- 4X points on dining, take-out, and delivery

- 2X points at grocery stores, gas stations, and streaming services

- 1X point on everything else

- Welcome bonus 20,000 points after spending $1,000 in 90 days

- 0% intro APR for 15 billing cycles

- Variable APR 18.24%–28.24% afterward

- No annual fee

Altogether, points redeem easily for travel, statement credits, or gift cards, keeping value flexible.

U.S. Bank Smartly™ Visa Signature® Card

Prefer simplicity? A flat rate removes category tracking.

- 2% cashback on every purchase—uncapped

- Up to 4% cashback when linked to a U.S. Bank Smartly Checking or Savings account

- 0% intro APR for 12 billing cycles

- Variable APR 18.49%–28.74% after promo

- No annual fee

This card suits steady spenders who want predictable returns without quarterly maintenance.

State Farm® U.S. Bank Credit Cards

Ideal for policyholders seeking extra value on insurance payments.

- 3% cashback on State Farm insurance premiums

- 2% cashback at gas stations, restaurants, and grocery stores

- 1% cashback on everything else

- No annual fee

Owners who are already budgeting monthly premiums gain effortless rewards on a cost they must pay anyway.

Pick category-based cards when expenses cluster in specific areas, or choose a flat-rate card for broad, no-thought rewards.

Secured Cards: Build or Rebuild Credit—and Still Earn

Secured products mimic mainstream reward structures while helping you establish positive payment history. Deposit amounts become your credit limits, and responsible use paves the path to unsecured upgrades.

U.S. Bank Altitude® Go Secured Visa® Card:

- 4X points on dining, takeout, and delivery

- 2X points at groceries and gas stations

- Annual streaming credit $15

- No annual fee

- Security deposit $300–$5,000 sets the line

U.S. Bank Cash+® Secured Visa® Card:

- Mirrors Cash+ reward tiers: 5%, 2%, 1% structure

- No annual fee

- Security deposit defines the credit limit

Both options offer real-world cash back or points while helping to strengthen your credit. Upgrading becomes possible after timely payments demonstrate reliability.

Balance Transfer vs Cashback: Decide Based on Your Priority

Clarity on your immediate goal prevents costly missteps.

- Carrying debt? A balance transfer card slashes interest, letting you zero out balances faster.

- Paying in full each month? A cashback card converts purchases into cash or points without accruing interest.

Consider these filters when choosing:

- Intro APR Length

- Large balances align with the 24-cycle Shield Visa.

- Moderate debt may fit an 18-cycle Business Platinum.

- Variable APR Afterward

- Factor future rates into payoff timelines.

- Fees and Category Activation

- Balance transfer fees can offset savings if ignored.

- Missing a quarterly activation on Cash+ drops earnings to 1%.

Quick Application Checklist

Submitting a complete, accurate application speeds approval worldwide.

- Gather legal name, date of birth, full address, and Social Security number.

- Note yearly income and monthly housing payment.

- Decide whether to initiate a balance transfer or add authorized users.

- Apply on usbank.com or visit a branch.

- Review all terms, especially intro APR deadlines and fee schedules, before final submission.

Most decisions are made within minutes, although additional verification can extend the timeline.

Smart Habits to Maximize Every U.S. Bank Card

Short routines protect your credit score and stretch rewards.

- Pay the full statement balance before the intro APR period ends.

- Schedule automatic payments to avoid late fees worldwide.

- Align bonus categories with top monthly expenses, such as gas or streaming.

- Link eligible checking or savings accounts for boosted Smartly cashback.

- Monitor spending through the U.S. Bank mobile app and adjust categories each quarter.

Interest Rate Snapshot

Staying aware of APR ranges safeguards your budget.

- Shield Visa: 0% intro APR 24 cycles → 17.74%–28.74% variable

- Cash+ Visa Signature: 0% intro APR 15 cycles → 18.49%–28.74% variable

- Smartly Visa Signature: 0% intro APR for 12 cycles → standard variable APR

Credit scores on the higher end generally qualify for the lower range in each bracket.

Customer Support and Contact Channels

Worldwide assistance is available by phone, mail, or mobile app.

- Phone: 800-USBANKS (872-2657) or 00 1 503-401-9991 internationally

- Mail: U.S. Bank, 800 Nicollet Mall, Minneapolis, MN 55402, USA

- Mobile App: iOS and Android platforms for real-time account management

Verify card terms periodically; promotions and rates can change without notice.

Conclusion

Selecting a U.S. Bank credit card hinges on clarity about current objectives. Choose balance transfer products to wipe out interest quickly, or select cashback options that turn everyday spending into tangible returns.

Review intro APR lengths, reward structures, and any required activations before applying. Following these guidelines positions you to save money, earn consistent rewards, and keep your finances on track worldwide.

Disclaimer: Credit approval, promotional periods, APRs, fees, and reward terms are subject to change. Always consult U.S. Bank’s official resources for the most current information before applying. This content is for informational purposes only and does not constitute financial advice.